who pays sales tax when selling a car privately in michigan

In order to ensure a smooth transition for retailers whose only obligation to collect Michigan sales tax comes from these new standards a remote seller must register and pay the Michigan tax. In cities like Detroit Lansing and Kalamazoo Michigans Craigslist can prove to be a viable option for selling your car.

Dealer Manual State Of Michigan

Before the Tax Cuts and Jobs Act you could trade a business vehicle tax-free under Section 1030.

. You can find these fees further down on the page. Several examples of exceptions to this tax are vehicles. If i sell my car do i pay taxes.

In a nutshell the Internal Revenue Service IRS views all personal vehicles as capital assets. Out-of-State Title Transfers in Michigan After Buying or Selling a Vehicle. The most expensive standard sales tax rate on.

Gifting the car and she will need to pay sales tax on the cars actual market value. If for example you. The buyer must pay any sales taxes when the new title is applied for or provide proof that the sales taxes have been paid.

You can sell your daughter a car for 1 if you want but you dont save much work vs. If you own a car whether you purchased it new from a dealer or used from a private seller theres a 99 chance that you are liable to pay taxes when buying a car. Tax owed on all vehicle transfers.

The Michigan Department of Treasury. Michigan collects a 6 state sales tax rate on the purchase of all vehicles. In the state of Michigan sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

But permits valid 30 days cost 10 of the annual registration fee or 20 whichever is higher. Now its time to sell it. How Much is the Average Sales Tax Rate on Cars.

In addition to taxes car purchases in Michigan may be subject to other fees like registration title and plate fees. The buyer is responsible for paying the sales tax according to the sales tax rate in the jurisdiction where you sell the vehicle. August 1 2016 CPAs Business Consultants.

Michigan collects a 6 state sales tax rate on the purchase of all vehicles. You would not have to report this to the irs. 2018 Taxes and Business Vehicles.

To calculate how much sales tax youll owe simply multiple the vehicles price by 006625. Sales tax is charged every time a vehicle is bought or sold regardless of sales tax paid by a previous buyer. The tax on the transfer of a vehicle is 6 percent on the greater of the purchase price or the retail value of the vehicle at the time of transfer.

The average sales tax rate on vehicle purchases in the United States is around 487. Yes you must pay vehicle sales tax when you buy a used car if you live in a state that has sales tax. The buyer will have to pay the sales tax when they get the car.

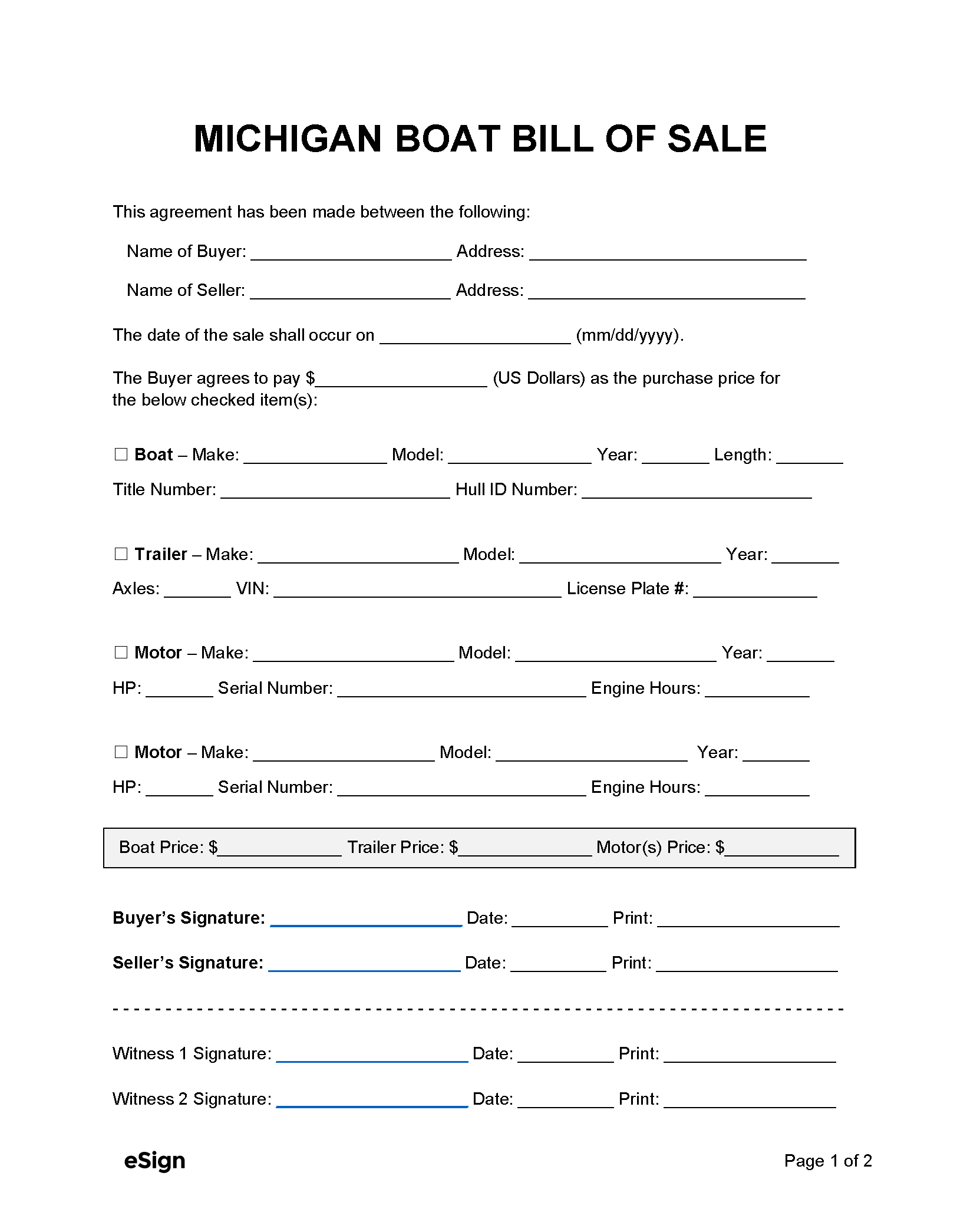

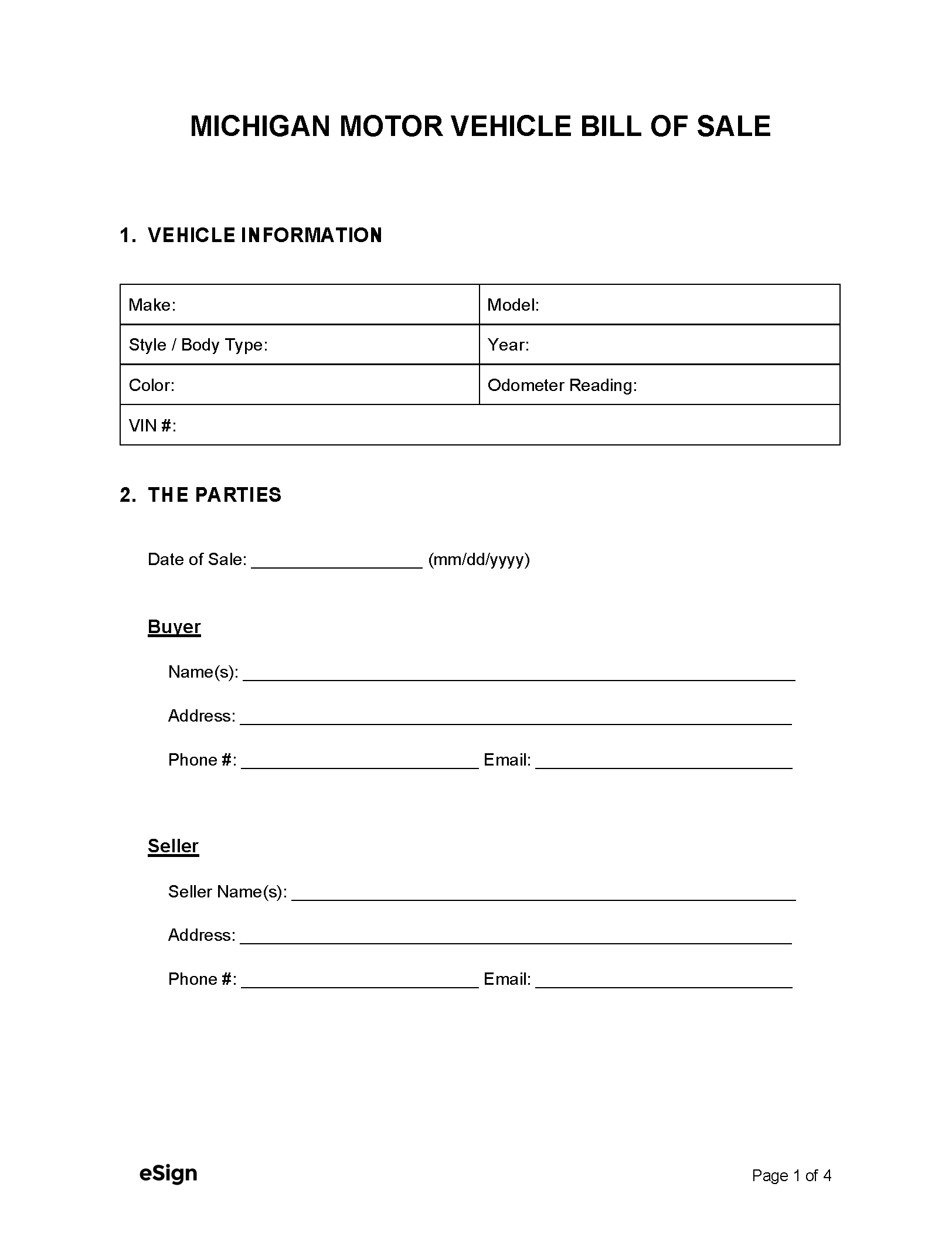

If a vehicle is purchased from an Indiana dealership the dealer will collect the sales tax and provide proof of the sales tax paid on an ST108 Certificate of Gross Retail or Use Tax Paid. Enter the part of the sellers property including the mileage date of sale and sale price of the vehicle. Find out more about the out of state car title transfer process in Michigan today.

If you sell it for less than the original. If you buy another car from the dealer at the same time many states offer a trade-in tax exemption that lowers the amount of sales tax youll pay in the trade. It depends on the length of the permit.

How much do temporary permits cost. If you are selling. Under Michigan SalesUse Tax Statutes a casual seller ie not a licensed new or used vehicle dealer is not responsible for.

Income Tax Liability When Selling Your Used Car. However you do not pay that tax to the car dealer or individual selling the. Typically when you buy a car in a different state than your home state the car dealer collects your sales tax at the time of purchase and sends it to your home states relevant.

Who Pays Sales Tax When Selling A Car Privately In Michigan at Tax. Selling a car can be done through a couple of different routes. You may even find that a local Michigan sales group on Facebook is pretty good.

Private vehicle transactions in Michigan require a 6 tax due on the full purchase price or fair market value of the vehicle whichever is greater. Proof of Sale Once a car is sold between parties in Michigan the. However the new law eliminates that.

Sales Tax On Cars And Vehicles In Michigan

How To Sell A Car In Michigan What The Sos Needs From Sellers

Free Michigan Bill Of Sale Forms Pdf Word

Mega Millions Ticket For 1 Billion Jackpot Was Sold In Michigan The New York Times

Car Sales Tax In Michigan Getjerry Com

How To Sell A Car In Michigan What The Sos Needs From Sellers

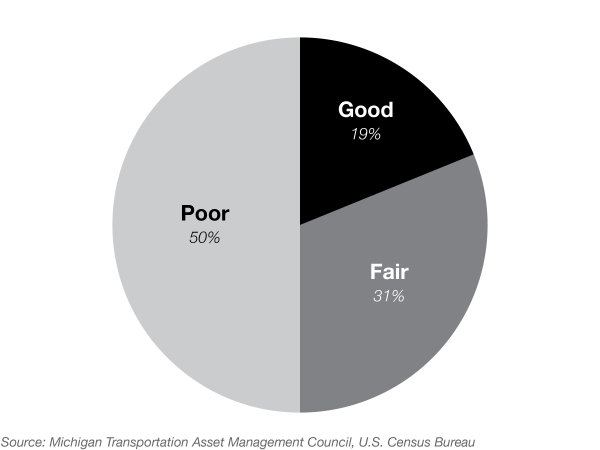

How Road Funding Works In Michigan Roads In Michigan Quality Funding And Recommendations Mackinac Center

History Of Warren Michigan Warren Center Line History

Sales Listings At Sandy Pines West Michigan Campground Rv Resort

Dealer Manual Chapter 3 State Of Michigan

Michigan Title Transfer Etags Vehicle Registration Title Services Driven By Technology

Michigan Sales Tax Small Business Guide Truic