ny highway use tax form mailing address

New York State Dept. This is a more traditional way of filing your New York Highway use tax.

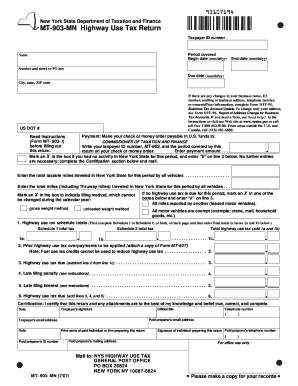

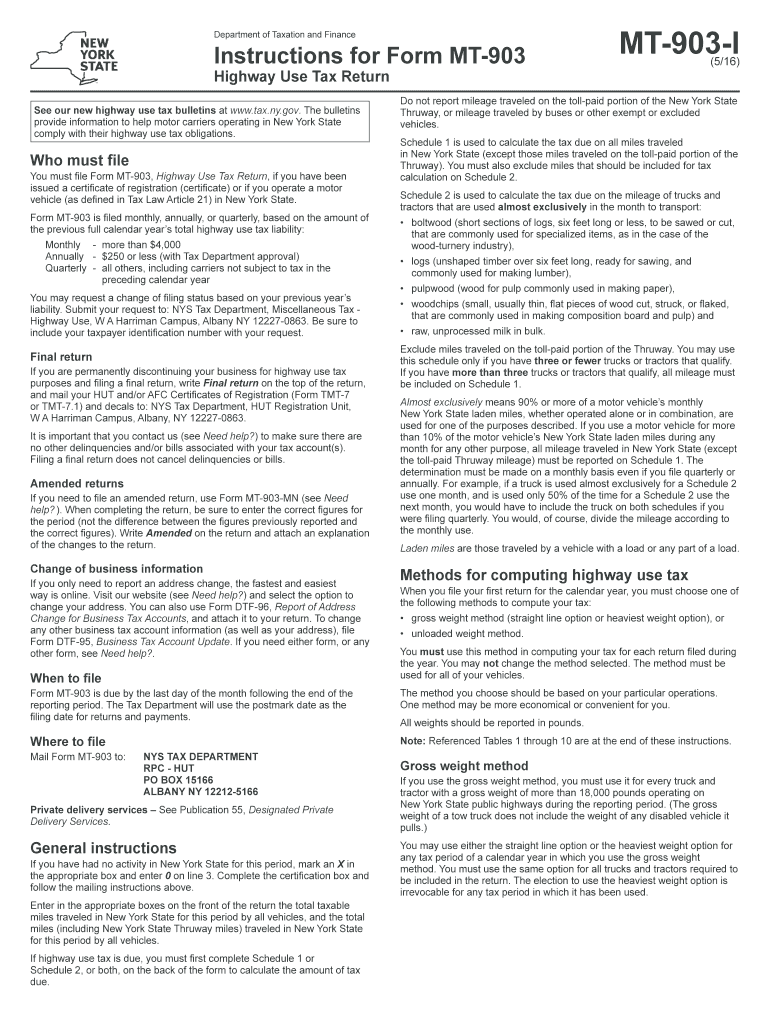

Ny Highway Use Tax Form Mt-903.

. Ny Highway Use Tax Form Mt-903. If you are filing a Form 2290 paper return. NYS Taxation and Finance Department HUTIFTA Application Deposit Unit WA.

HUTIFTA Application Deposit Unit. 518 457-5342 For forms and publications call. We have a dedicated team of.

Of Motor Vehicles 518. Harriman Campus Albany NY 12227-0163 Phone. Just download Form MT-903 and fill it out.

These tables are to be used for the period january 1 2001 through march 31 2001. New York State Dept. One is based on the mileage that you have traveled on New York State Public Highways.

For forms and publications call. 122 legal name mailing address number and street or. New York State Thruway Authority Canals 518 471-5010.

See Tax Bulletin An In See more. Our Tax Experts Are Here to Help. You are then required to mail it to the address given on the form.

122 legal name mailing address number and street or po box. Determining Your New York Highway Use Tax. The Federal Heavy Vehicle Use Tax HVUT is required and administered by the Internal Revenue Service IRS.

These tables are to be used for the period january 1 2001 through march 31 2001. If additional charges are going to be authorized a new form will have to be completed. Mail Form 2290 to.

Of Tax Finance Highway Use Tax Permit. New York State imposes a highway use tax HUT on motor carriers operating certain motor vehicles on New York State public highways excluding toll-paid portions of the New York State Thruway. This tax can be calculated in two ways.

Federal law requires proof that the HVUT tax was paid when you register a. New York Heavy Use Tax. NYS Taxation and Finance Department.

22 rows DTF-406. With full payment and that payment is not drawn from an international financial institution. A HUT certificate of registration is required for any truck tractor or other self-propelled vehicle with a gross weight over 18000 pounds in the State of New York.

The TOTAL COST includes all Federal State and Local Government fees. The tax rate is based on the weight of the motor vehicle and the method that you choose to report the tax. You may think that nobody wants to go through tax codes and regulations but here at New York Highway Use Tax we love it.

Claim for Highway Use Tax HUT.

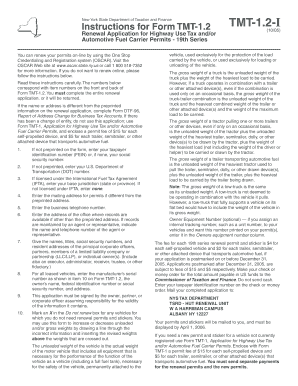

Download Instructions For Form Tmt 1 Application For Highway Use Tax Hut And Automotive Fuel Carrier Afc Certificates Of Registration C Of R And Decals Pdf Templateroller

Oregon Filing Archives Page 2 Of 2 Global Multiservices

It S A Global Phenomenon Now New York Is Poised To Lead The Nation In Congestion Pricing Politico

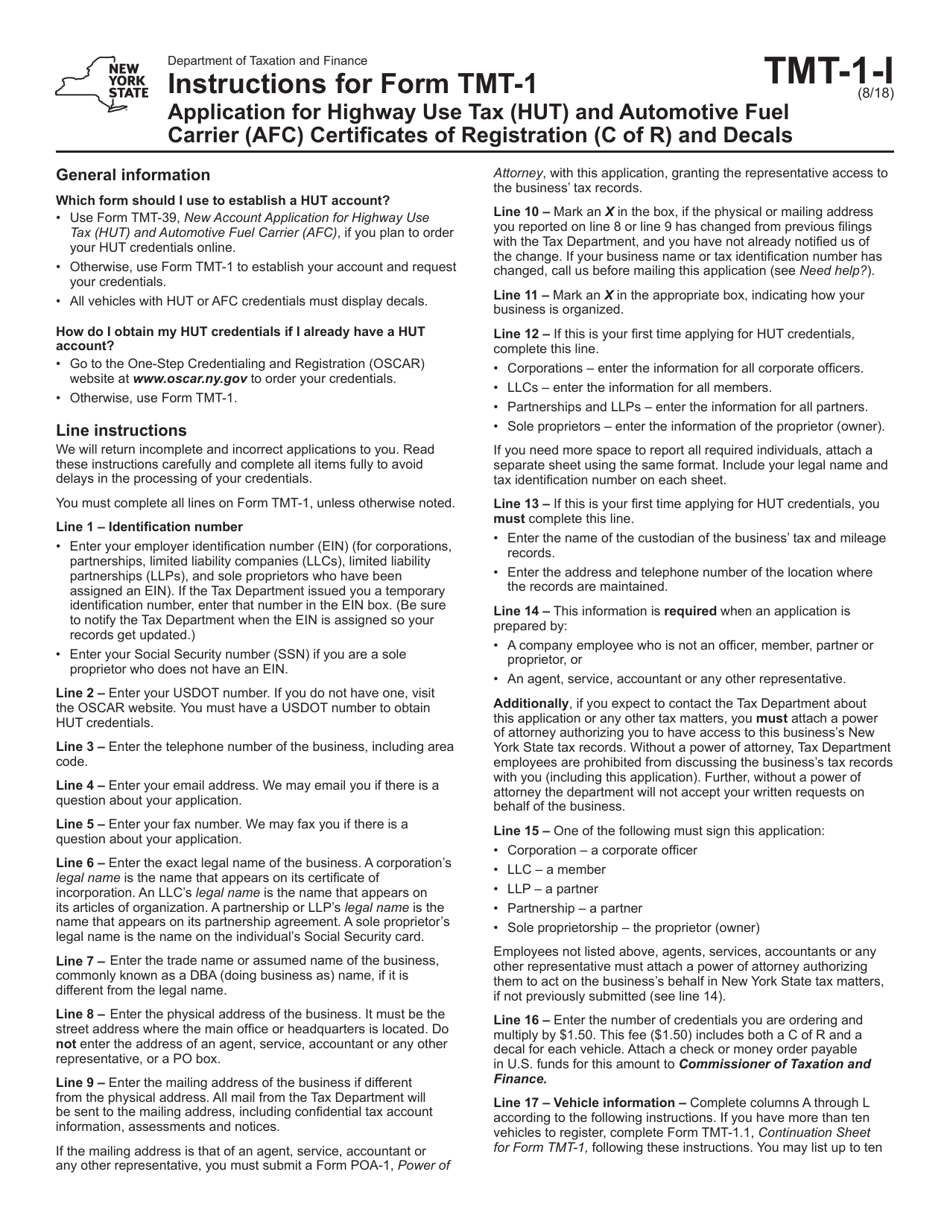

Ny State And City Payment Frequently Asked Questions

Sales Taxes In The United States Wikipedia

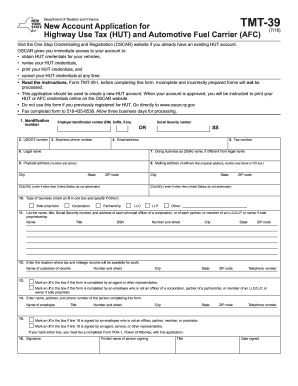

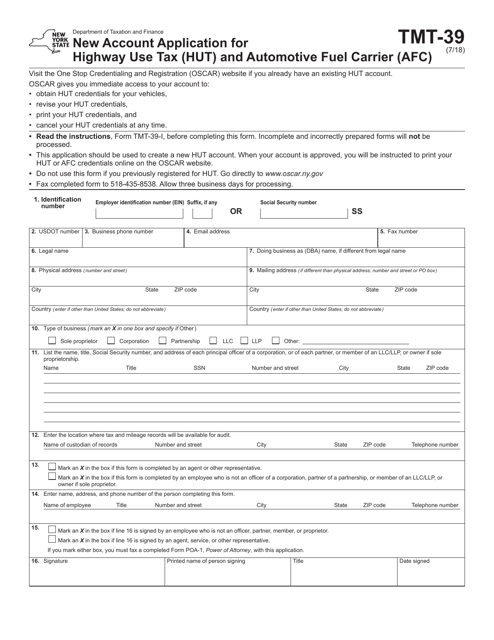

Get And Sign Tmt 39 Form 2018 2022

How To File And Pay New York Weight Distance Tax Ny Hut New York Highway Use Tax Youtube

Street Closures Sunday As Five Boro Bike Tour Returns

Form Mt 903 Mn707 Highway Use Tax Return Mt903mn Fill Out And Sign Printable Pdf Template Signnow

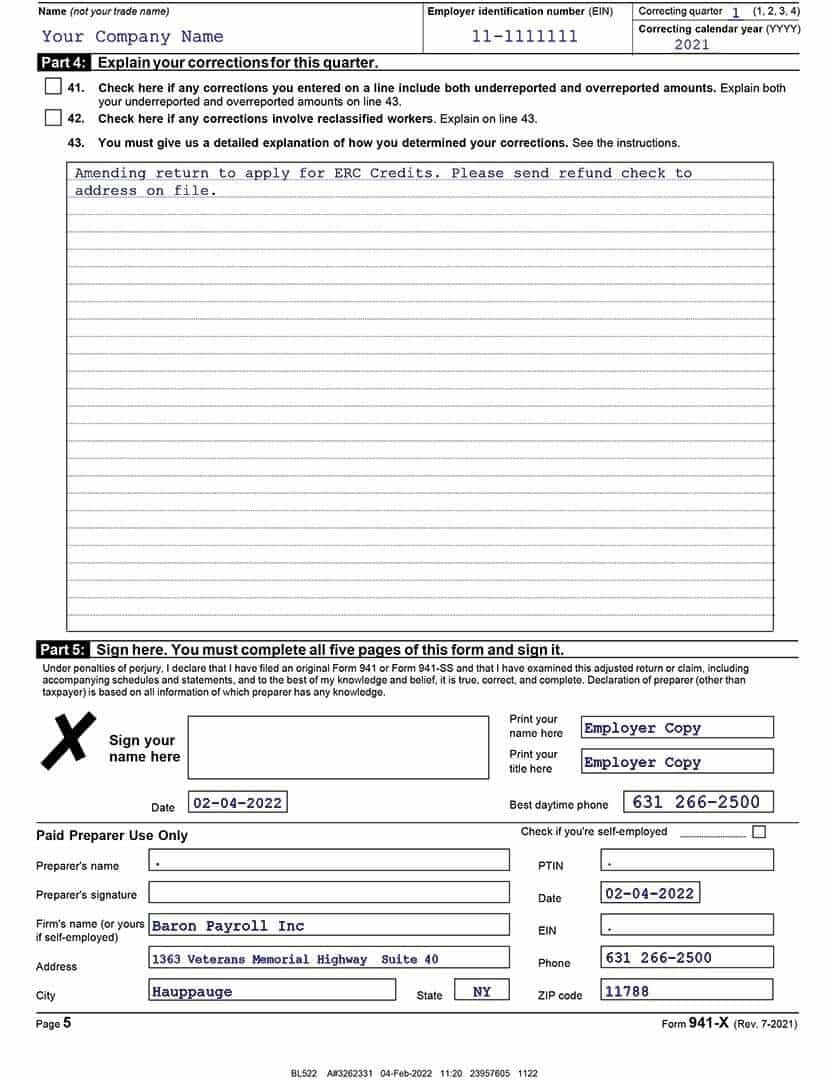

Step By Step How To Guide To Filing Your 941 X Ertc Baron Payroll

Mt 903 Fill Out Sign Online Dochub

Nyc Dot Trucks And Commercial Vehicles

Learn The Us Dot Terminology Glossary Us Decals

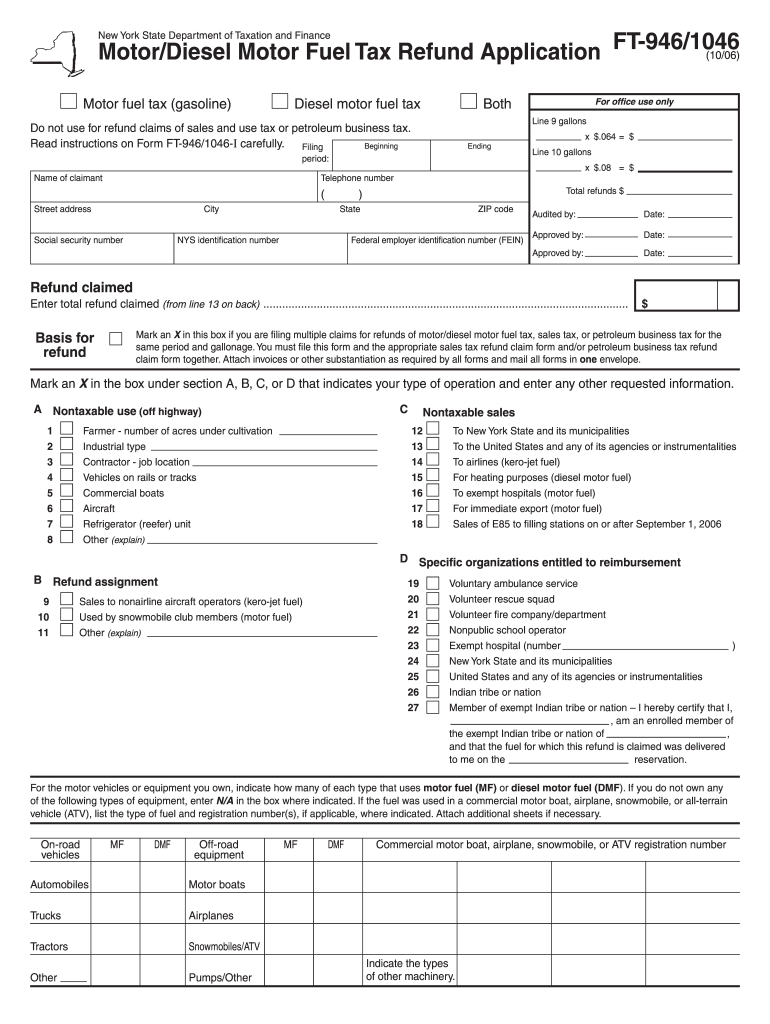

Form Ft 9461046 2006 Fill Out Sign Online Dochub

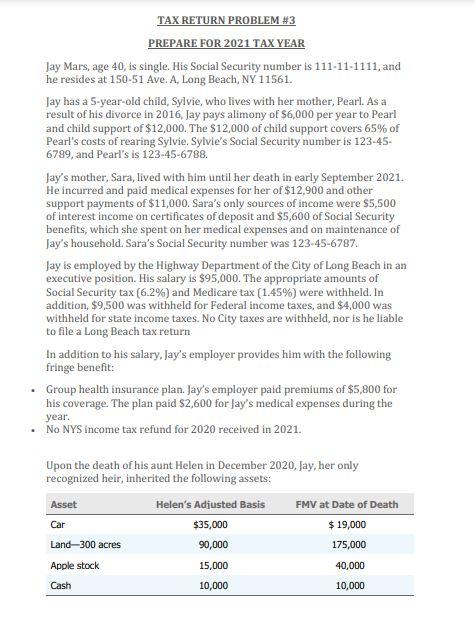

Solved Tax Return Problem 3 Prepare For 2021 Tax Year Jay Chegg Com

New York Issues Guidance On How To Report The Decoupling From The Cares Act On The Personal Income On Tax Forms It 201 It 203 It 204 And It 205

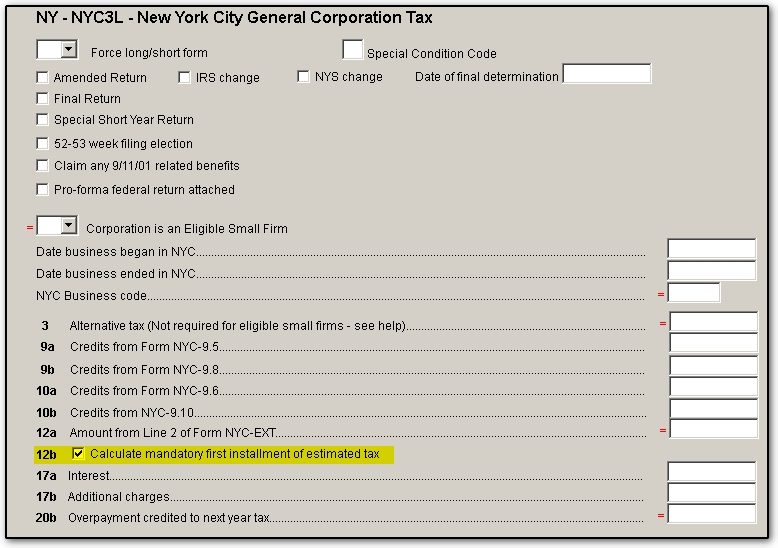

Form Tmt 39 Download Fillable Pdf Or Fill Online New Account Application For Highway Use Tax Hut And Automotive Fuel Carrier Afc New York Templateroller